Are You

The Best?

We enable talented professionals around the world to qualify for awesome remote jobs—with Silicon Valley pay. Ready to prove your skills?

What We Do

Crossover matches awesome people with awesome jobs.

- We find talented professionals around the world (7 million and counting).

- Empower them to prove their aptitude, abilities & attitude are world-class.

- Enable companies to recruit the best 1% for premium remote full-time jobs.

Why Crossover

Recruitment sucks. So we’re fixing it.

The Olympics of work

It’s super hard to qualify—extreme quality standards ensure every single team member is at the top of their game.

Premium pay for premium talent

Over 50% of new hires double or triple their previous pay. Why? Because that’s what the best person in the world is worth.

Shortlist by skills, not bias

We don’t care where you went to school, what color your hair is, or whether we can pronounce your name. Just prove you’ve got the skills.

TOP 1%

OF GLOBAL TALENT

130+

COUNTRIES

7M+

Accounts Created

5,000+

ROCKSTARS RECRUITED

Find out why...

Watch Video

Reviews

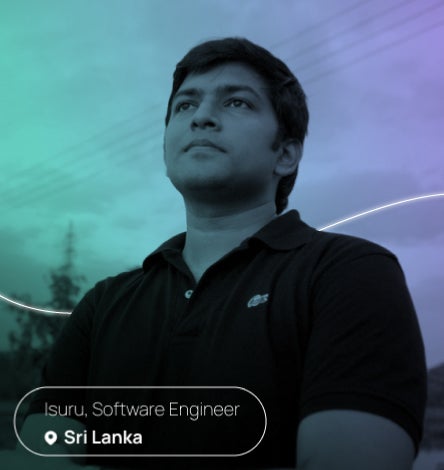

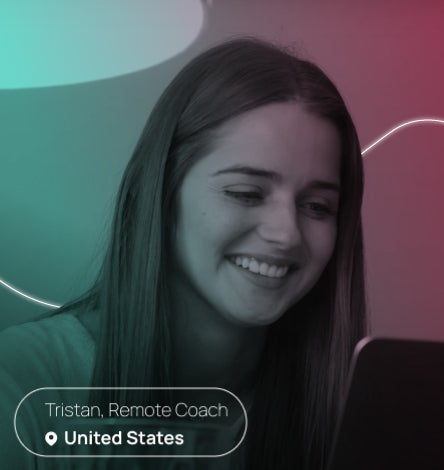

See All ReviewsMeet some of the 5,000+ rockstars who have found a rewarding remote career on Crossover.

Current Openings

See All JobsHere are a few of the jobs that our clients are currently hiring from Crossover’s talent pool.

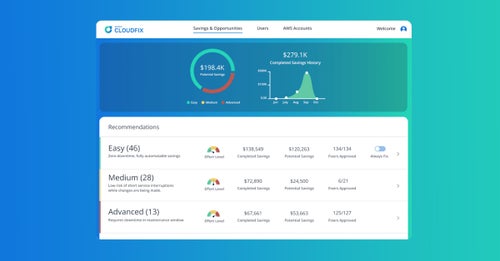

Companies that trust Crossover

Hiring nowHow it works

Applying for a role? Here’s what to expect.

We’ve curated a series of steps that take the guesswork (and cognitive bias) out of recruiting the best person.

STEP 1

Pass Cognitive Aptitude Test.

STEP 2

Pass English Proficiency Test.

STEP 3

Prove Real-World Job Skills.

STEP 4

Ace An Interview Or Two.

STEP 5

Accept Job Offer.

STEP 6

Celebrate!

Blog

View AllFrom the big picture to the tiny details, everything you need to kickstart your remote career is right here.

Are you the best? Our top clients are looking for you!

Popular Job Roles

- Remote Account Management Jobs

- Remote AI Engineer Jobs

- Remote Angular Developer Jobs

- Remote Back-end developer Jobs

- Remote C++ developer Jobs

- Remote Channel Sales Jobs

- Remote Customer Success Jobs

- Remote Customer Support Jobs

- Remote Developer Jobs

- Remote DevOps Engineer Jobs

- Remote Education Jobs

- Remote Engineering Leadership Jobs

- Remote Engineering Management Jobs

- Remote Executive Leadership Jobs

- Remote Finance Jobs

- Remote Front-end Developer Jobs

- Remote Full Stack Developer Jobs

- Remote Inside Sales Jobs

- Remote Java Developer Jobs

- Remote PHP Developer Jobs

- Remote Product Design Jobs

- Remote Product Management Jobs

- Remote Professional Services Jobs

- Remote Python Jobs

- Remote Quality Assurance Jobs

- Remote React JS Developer Jobs

- Remote Computer Programming Jobs

- Remote Ruby on Rails Jobs

- Remote Sales Leadership Jobs

- Remote Services Leadership Jobs

- Remote Software Architecture Jobs

- Remote Software Developer Jobs

- Remote Software Engineering Jobs

- Remote Strategy Jobs

- Remote Javascript Developer Jobs

- Remote C# Developer Jobs

- Remote Web Developer Jobs

![The Crossover Cognitive Aptitude Test [Official CCAT Guide]](https://assets-us-01.kc-usercontent.com:443/7beb5311-75a4-0049-50f5-8f58fd55aba7/57f22476-19f4-4309-a615-a27b35061cda/CCAT_Guide_Header2.jpg?fm=jpg&auto=format&w=500&h=500&fit=clip)