Contents

- Flipping The Currency Equation

- What Obstacles Stand in Your Way if You Earn Local Currency?

- Fixing The Currency Equation in Your Favor

Do you work more every year, but seem to earn less? Here’s how highly successful non-US remote workers build wealth with remote work.

“Pay yourself first.”

“Save 10% of everything you earn.”

“Invest before you spend.”

This is excellent advice – and perfectly useless when you’re a remote worker living in a developing country and can barely afford groceries or petrol for your car.

Most of the time it’s because the odds are stacked against you.

- Not because you don’t work hard.

- Not because you aren’t talented.

- And not because you’re irresponsible with money.

For many remote workers outside of the US, things like generational wealth and fair labor practices belong in the same category as Disney movies – they’re nice stories, but they don’t bear any resemblance to reality.

You can be at the TOP of your field and still struggle to get by.

That’s what happens when your income is tied to your local economy.

If where you live is prone to economic fluctuations, you will earn less and less over time. And you’ll end up working more and more. Like money, this compounds, and isn’t sustainable.

It’s a broken equation.

Controversial opinion: Before you take any traditional financial advice from popular business books, you must address the reality of local currency.

It can be ugly!

So, I’m going to explore the challenges of wealth generation for remote workers in developing nations, and propose a way to overcome them. By tapping into the ‘work from anywhere’ power of remote work you can change your financial future.

We see it every day here at Crossover.

It’s time to fix the equation in your favor.

Flipping The Currency Equation

If you’re running low on cash, work harder.

That’s a nice fanciful idea, but it’s not grounded in logic.

Local Currency + Local Job = Financial Instability

With this formula:

More Work ≠ More Money.

When you work inside an economic system that uses you as an expendable variable in an equation that adds up to you either leaving your job – or being financially strapped forever – that’s an issue.

Local currencies in developing nations are problematic for remote workers who want to build wealth for themselves.

Your Pay Buys Less

Local currency is eroded by out-of-control inflation, which means even if you earn 6% more during the year, what you earn buys less. Because of rising prices, you just can’t afford the same amount of goods or services.

- In Bangladesh food costs surged to 12.54%, while pay growth hovered around 7.58%.

- In South Africa, pay growth was around 3.8% while inflation averaged at 6.9%.

When pay growth doesn’t outpace inflation, your purchasing power falls flat. If you’ve found yourself wondering why your budget isn’t going as far – this is why.

More Work ≠ More Money for Remote Workers.

What Obstacles Stand in Your Way if You Earn Local Currency?

There are treacherous obstacles to building wealth that aren’t as severe in developed countries. Here are some of the challenges faced by non-US remote workers.

1. Wage Theft

Have you ever had to work late or over a weekend with no overtime pay?

That’s wage theft. And tech companies from Microsoft to Google have been accused of it over the years. Everyone wants to work for Google, so they do it.

And competition for global tech jobs is fierce, so it’s often done to avoid being laid off or seen as ‘not being a team player’. There aren’t many studies about it in Africa or India, but in the US about $3 billion in stolen wages was recovered between 2017 and 2020.

Pity you can’t pay for food with experience.

2. Exploitative Labor Practices

Have you ever been given someone else’s work to do after they left the company?

It’s not uncommon for companies to save a buck by splitting the work done by a previous employee, among existing employees – or one unfortunate person.

Any practice that forces you – without compensation – to go beyond your original contract agreement is exploitation. This happens extremely often in developing countries, whether you work for local, or international companies.

Eventually, remote workers are forced to leave because of workload and stress.

3. Candle Culture

Do you constantly feel like you’re working more and more – for nothing?

Candle culture is when your boss lights you on both ends, and you burnout! Tech labor practices in developing countries are challenging because you can be treated as disposable or replaceable.

Bad global outsourcing practices have normalized this for a lot of remote workers.

Limited worker rights and protections means you’re at the mercy of whatever your boss wants you to do…for however long.

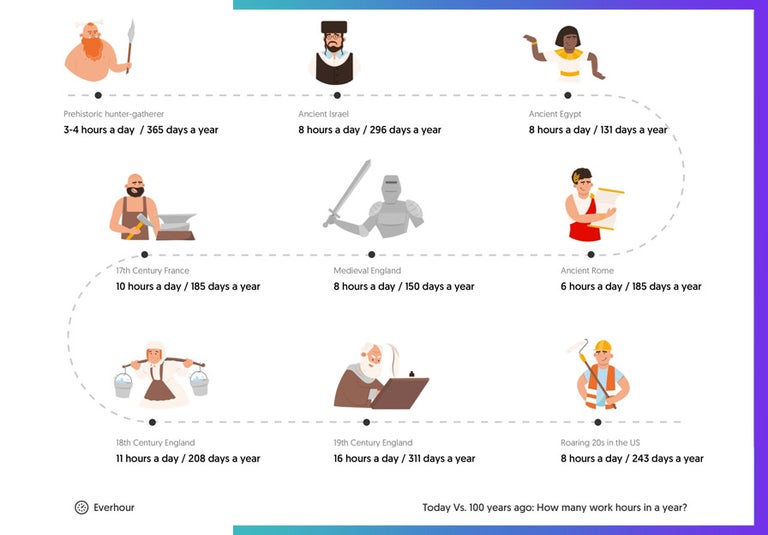

- Hunter-gatherers worked for 3-4 hours a day / every day.

- Medieval England worked for 8 hours a day / 150 days a year.

- Today we work 8 hours a day / 52 weeks a year on average.

- In South Africa and Pakistan the average hours are 49+ a week.

Candle culture forces remote workers to jump ship every few years, or suffer the consequences of staying put in an unfriendly work culture.

You can see how the odds are being stacked against you as a non-US remote worker.

Not only do you have the dwindling purchasing power of your pay to worry about, but it’s also likely that you’re experiencing lower pay, wage theft, exploitation and candle culture too.

But don’t forget – to pay yourself first!

Fixing The Currency Equation in Your Favor

Remote work is powerful when you look outside the bounds of your own country. And there is an excellent way to immediately break free of local currency instability.

I’m talking about earning USD.

If you’re a non-US remote worker who earns a weak currency, you’re going to struggle to have excess, and can’t rely on local jobs to bridge the gap.

- No amount of working more will help you.

- No amount of accepting low international pay will help you.

You need to fix the currency equation.

American dollars are a highly stable global currency.

They shield you from local economic downturns, inflation and recession. When your economy plummets – the dollars you earn will give you higher purchasing power in tough times.

You’ll never find yourself at the mercy of increasing costs when you earn enough US dollars. And having readily available cash, saves you money.

Before you can apply principles like the one found in the classic “The Richest Man in Babylon” you must adjust your formula.

Strategic Planning First. Then Financial Savvy!

- Switch currencies: Go from earning local, to earning US dollars. Give yourself the purchasing power you need to have excess you can do things with.

- Eliminate bad remote jobs: To succeed, you need to find the right remote job with an international company that pays you well and doesn’t exploit you! That means no wage theft, no pay inequality, and no low outsourcing rates.

Only once you’ve done this can you move to the second part of the equation!

- Apply popular financial advice: The ‘pay yourself first principle’ comes from George S Clason’s book, and it speaks about keeping what you earn, for your future self. Before you spend anything on bills – you save 10%. That’s yours.

Then instead of compounding poverty, burnout and stress – you build wealth and freedom.

Isuru, Diego, Aliza and Kaan are just a few non-US remote workers who altered the currency equation and changed their lives.

The moment they decided to apply for a job with Crossover was the turning point.

It all starts with this:

US Dollars (Currency) + The Right Remote Job (Courage) = Financial Stability

To really pay yourself first as a non-US remote worker remember this: there are obstacles you need to overcome to simplify your shot at success.

Stop working on the wrong things and applying faulty formulas.

It’s so easy to feel like you’re on the right track when you’re on the wrong train!

Ask yourself – where are you really heading?

Switch to US dollars to transform what is possible with your finances.

Your hard work has a value that shouldn’t be subject to economic shifts. That’s why you go to work. Not to spend your life working, but to build a life worth living.

And that means trading in the mindless grind for the boundless potential of remote work done right.